That’s what most of us would think. But we would all be wrong.

Apparently the Fed has no interest in gold. On July 18, 2013, Fed Chairman Ben Bernanke testified to Congress that “nobody really understands gold prices, and I don’t pretend to understand them either.” And when former congressman Ron Paul asked Bernanke why, then, the Fed holds gold, he said it did so only because of “tradition.”

For the Fed, giving away our gold is no big deal.

But we think that’s a mistake of historical proportions.

Throughout history gold has always flown to where wealth was being created… from Athens to Rome to the Byzantine Empire.

Our huge gold holdings in the US after World War II were a clear reflection of our unique economic power.

Just look at what happened to Britain when it started selling off its gold…

The country was on the gold standard for nearly 200 years, from 1717 until 1914. That was a prosperous period for British Empire.

During that time, the country gave birth to the industrial revolution and ruled one fourth of the earth and its people.

The British pound was the reserve currency of the world…and this looked like it would last forever.

But Britain abandoned the gold standard in 1914 to start printing money. And it sold 30% of its gold from 1928 to 1931. That was the beginning of the end for the British pound as the world’s reserve currency.

Pretty soon the country was flat broke.

At one point in 1967 the British currency lost 14% of its value overnight. Inflation got out of control, reaching 27% a few years later.

There were endless strikes in nearly every sector, including grave diggers, trash collectors, and hospital workers. Things got so bad at one point mothers giving birth had to bring their own linens to the hospital.

In short, Britain’s whole economic system and society collapsed.

And now we’re on the cusp of reliving a similar history. We’re about to learn – the hard way – what the British discovered:

Empires Don’t Last Forever

If the U.S. still was a manufacturing superpower… if we still had one of the fastest growing economies… if we still had a thriving middle class, we’d be fine.

If our country was in great financial shape, having no gold reserves wouldn’t be a problem.

But we all know that’s not the case today.

Back in 1980, the U.S. national debt was less than $1 trillion. Today, it’s more than $17 trillion, which is the greatest debt in the history of the world.

And this doesn’t even account for our unfunded liabilities, which our government keeps off the federal balance sheet. But Laurence Kotlikoff, a well-known Boston University economist, has estimated our total debt. Here’s what he told me recently: “I estimate the US fiscal gap at US$200 trillion. The US is arguably in worse fiscal shape than any other developed country. Six decades of “take as you go” has led us to a cliff. This is effectively a nuclear economic bomb. Our country is broke. It’s not broke in 50 years or 30 years or 10 years. It’s broke today.”

Even a report from the nonpartisan Congressional Budget Office has used such language as “unsustainable” and “train wreck” to describe the future of America’s finances.

So our country is not exactly a fortress of financial health. Far from it. For all practical purposes, the country’s only true collateral is its gold reserves.

But most of that is now gone.

And once the world discovers the truth about the Fort Knox fairytale…once it realizes our gold is gone and all we have to show for are trillions of debt that can never be repaid…

Trust in U.S. bonds and the dollar will be shattered in an instant, catching millions of Americans unprepared.

After that, our American psyche will never be the same again. Our nation will no longer be the world’s financial and economic powerhouse.

Because, whether you realize it or not, the “the full faith and credit” of our government is really the only thing backing the dollars in your wallet. Without trust, the dollar is worthless.

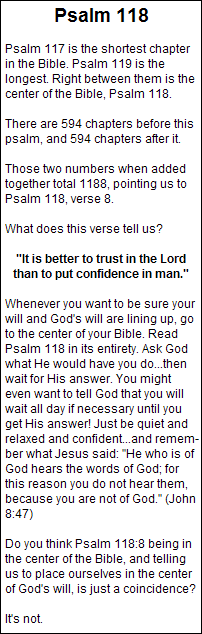

Most Americans don’t know this, but our paper dollars used to be freely convertible into gold coins. Take a look at this $20 dollar bill from 1905:

Its inscription reads: “This certifies that there have been deposited in the Treasury of The United States of America twenty dollars in gold coin payable to the bearer on demand.”

In and of itself, the paper money had no more value than any other piece of paper. It was the fact that this piece of paper could be converted directly into gold coins that gave confidence to our paper currency.

Of course, that’s no longer the case.

Pull any dollar bill from your wallet and take a closer look at it. Today’s Federal Reserve Notes are not backed by any real asset, and they omit any promise that they’re redeemable for anything.

Before 1971, at least the dollar was backed by gold. But since then, our entire monetary system has been based on nothing but trust.

The bottom line is this: If the “full faith and credit” of the US government is not to be trusted, then our currency will not be trusted, either. Not by other countries, and not by US citizens.

Sadly, that’s exactly what is about to happen.

Once that trust is lost, we will have nothing to fall back on. Demand for the U.S. dollar will fall off a cliff, driving the value of our currency much lower.

Remember, over the last three decades we’ve printed and exported a lot of dollars. It’s estimated that $3.7 trillion are held outside the U.S.

As trust in the dollar disappears around the globe, all the currency we’ve exported will race back into the country. The increased supply of money will bid up prices seemingly overnight.

Everything we consume will get much more expensive… all the gadgets, shoes and shirts we import from China… all the beer, wine and furniture we import from Europe…. and all the coffee, fruits and vegetables we buy from South America.

We can say goodbye to “everyday low prices.” We will no longer be able to find cheap electronics, toys and food in the shelves of Wal-Mart or any other retailer.

Oil will shoot toward $300 a barrel, pushing the price of gasoline towards $9.50 per gallon…things like corn, wheat, milk will skyrocket.

The standard of living of millions of people will collapse almost overnight… pension funds will be devalued, ruining the retirement plans of millions of Americans…global markets will plunge, as investors bail out of stocks.

Interest rates across the board will rise dramatically. Mortgage rates will climb up to 10%, killing the recovery in the housing market.

Higher borrowing costs will also kill consumer demand, sending our economy into a deep recession, much worse than the “great recession” of 2008.

With consumers spending less, businesses will be forced to initiate a cycle of massive layoffs. The unemployment rate will double- or worse.

Because of higher borrowing costs, our government will have to print even more money just to meet its obligations. This will only accelerate the run on the dollar.

And when all is said and done, when the shakeout finally settles, the global financial system will no longer be centered on the United States.

That change is happening now. Trust in the U.S. is waning fast.

Many nations have already started to abandon U.S. bonds. Take a look…

This past June, our two biggest creditors, China and Japan, dumped nearly $41 billion of their Treasury holdings. That was the largest net foreign decline on record.

They’re losing trust in America’s ability to manage its finances. For them, U.S. bonds are no longer risk-free assets.

In recent years, even companies such as Berkshire Hathaway, Proctor and Gamble and Johnson & Johnson have been able to borrow money at a lower interest rate than the U.S. government.

In other words, investors feel more confident lending money to certain companies than to our government. That has never happened before…. never.

Lenders have also started demanding a higher interest rate on American debt. This is another indication that our creditors are losing faith in our government. Take a look at this chart. Our borrowing costs have skyrocketed in recent months.

The yield on the U.S. Treasury benchmark bond – the 10-year note – went from 1.65% to almost 3%,one of the largest jumps in the history of our nation.

A few months ago investors were willing to lend money to our government for almost nothing.

But today nobody is willing to lend us money at such a low interest rate. Now our creditors are demanding a rate of almost 3%.

The recent debt ceiling debate, meanwhile, has tarnished our credibility even more. Following that debacle, a leading Chinese rating agency downgraded our debt, saying:

“The U.S. government maintains its solvency by repaying its old debts through raising new debts, which constantly aggravates the vulnerability of the federal government’s solvency. Hence the government is still approaching the verge of default crisis.”

Besides dumping U.S. bonds, other nations are also actively reducing their exposure to the U.S. dollar in other ways.

Many countries have made agreements that allow them to settle their trades in their own currencies, cutting the dollar out of the transaction completely. China, for example, has signed international currency agreements with 22 countries worldwide.

Because of these agreements, 17% of global trade in 2012 was completed using the Chinese currency, instead of the dollar.

Over the past couple of years, numerous global leaders have publicly criticized our currency. Chinese central bank governor Zhou Xiaochuan, for example, said the world needs “a sweeping overhaul of global finance to replace the dollar as the world’s standard.” And during our recent debt ceiling debate, China’s state-run news agency issued perhaps its most dire warning to date on the subject:

“As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world.”

Russian leader Putin, meanwhile, has said that “the world has gotten itself into trouble with its heavy reliance on the dollar.” While members of OPEC have repeatedly raised the idea that “maybe we can price oil in euros.”

The UK’s newspaper The Telegraph recently published the following article: (SHOW Headline and highlighted sections) “The Sun is Setting on Dollar Supremacy, and with it, American Power”

The article pointedly concludes that:

“Rarely before has international dissatisfaction with the dollar’s role as reserve currency to the world been as great as it is now. A steady erosion of trust which began with the financial crisis five years ago has reached apparent breaking point. The search for long-term alternatives to the dollar is on as never before.”

As you can see, confidence in America’s fiscal state and the dollar is already eroding very quickly. It wouldn’t take much to flush the “full faith and credit” of the U.S. down the toilet.

And that’s exactly what the Fed’s big gold cover up will do.

NORM ‘n’ AL Note: This article makes the point that we will likely see the “big flush” begin in this month of April, 2014.

[From an article published by THE SOVEREIGN SOCIETY]

………………………………..

As always, posted for your edification and enlightenment by

NORM ‘n’ AL, Minneapolis

normal@usa1usa.com

612.239.0970